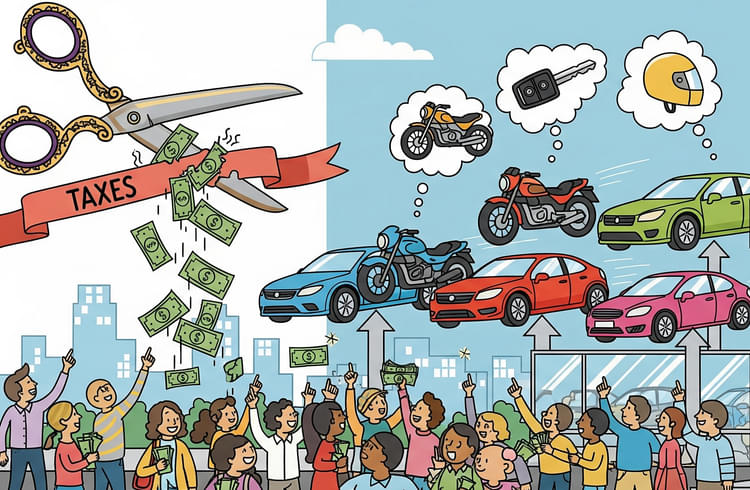

25 Percent Car Tariff Shock by Trump – Will Your Next Vehicle Cost $12,500 More? WASHINGTON — In a dramatic policy shift that could reshape the American auto industry, former President Donald Trump announced sweeping 25% tariffs on all imported vehicles, effective April 3. The move, framed as a bid to boost domestic manufacturing, has ignited fierce debate—with supporters hailing it as a long-overdue protectionist measure and critics warning of skyrocketing car prices, supply chain chaos, and a potential global trade war.

“Permanent” Tariffs Aim to Reshore Auto Jobs

Trump, a longtime advocate of aggressive trade policies, declared the tariffs would force automakers to shift production back to the U.S., ending what he called a “ridiculous” reliance on foreign supply chains. “We’re bringing back American jobs, and we’re doing it for good,” he said, emphasizing that the tariffs are “permanent.” The White House estimates the policy could generate $100 billion annually, though economists question whether the revenue will offset the economic fallout.

The announcement sent immediate shockwaves through the auto industry. Stocks of General Motors and Stellantis (parent company of Jeep and Chrysler) dropped sharply, while Ford—which has a stronger domestic manufacturing base—saw a slight uptick. Analysts warn that even U.S.-branded vehicles could face price hikes, as many rely on imported components.

Middle-Class Squeeze: Will Cars Become Unaffordable?

The biggest concern for consumers? Soaring prices. Mary Lovely, a senior fellow at the Peterson Institute for International Economics, estimates that the tariffs could add 12,500∗∗tothecostofanaverageimportedvehicle.Withnewcarpricesalreadynearrecordhighs—averagingaround∗∗49,000—Lovely warns that millions of families could be priced out of the market entirely.

“These tariffs are essentially a tax on working Americans,” she said. “People who planned to buy a new car may now be stuck driving older, less safe vehicles for years longer.” The used car market, already strained by pandemic-era shortages, could also face renewed pressure as demand surges.

Global Backlash: Canada and Europe Threaten Retaliation

International leaders reacted swiftly—and angrily. Canadian Prime Minister Mark Carney blasted the tariffs as a “direct attack” on his country’s auto sector, vowing to defend Canadian jobs. The European Union, which exports billions in vehicles to the U.S. annually, also pushed back hard.

“This is protectionism at its worst,” said European Commission President Ursula von der Leyen. “Tariffs hurt businesses and consumers on both sides of the Atlantic.” The EU is now weighing retaliatory measures, including targeted taxes on American goods—raising fears of a full-blown trade war that could destabilize the global economy.

A Possible Lifeline for Buyers?

In an attempt to soften the blow, Trump floated a federal tax deduction for interest paid on auto loans—but only for buyers of American-made vehicles. While details remain vague, the proposal could provide some relief to consumers. However, experts note that the deduction would likely erode much of the tariff revenue, undermining the policy’s financial rationale.

Broader Trade War Looming?

The auto tariffs are just one piece of Trump’s aggressive trade agenda. His administration has already imposed:

- 20% tariffs on all Chinese imports (citing fentanyl concerns)

- 25% duties on select Mexican and Canadian goods

- 10% tariffs on Canadian energy products

Some of these measures were temporarily paused after industry backlash, but the auto tariffs appear set in stone—for now. Trump has also teased upcoming “reciprocal tariffs” that would match other nations’ import taxes, a move that could further escalate tensions.

Can U.S. Automakers Adapt Fast Enough?

The central question remains: Will these tariffs actually bring manufacturing back to America? While Trump insists they’ll spur new factory openings, industry insiders say reshoring production is a years-long process. Automakers must secure domestic suppliers, retool plants, and navigate complex labor and regulatory hurdles—all while facing higher costs in the short term.

“Companies can’t just flip a switch and move production,” said one Detroit-based auto executive, speaking anonymously. “In the meantime, consumers will pay the price.”

The Political Fallout

The policy is already becoming a flashpoint in the 2024 election. Trump’s base cheers the tough-on-trade stance, while opponents call it economic malpractice. Democrats warn that working-class families—many in key swing states like Michigan and Ohio—will bear the brunt of higher prices.

What’s Next?

As April 3 approaches, automakers are scrambling to adjust their strategies. Some may absorb part of the tariff costs to avoid shocking buyers, while others could speed up plans for U.S. production. But one thing is certain: the auto market—and the broader economy—are in for a turbulent ride.

Final Verdict: Bold Gamble or Economic Self-Sabotage?

Trump’s tariffs represent one of the most aggressive trade moves in decades. If successful, they could revitalize American manufacturing. But if they backfire, the consequences—soaring prices, job losses, and global retaliation—could haunt the U.S. economy for years. The stakes couldn’t be higher.