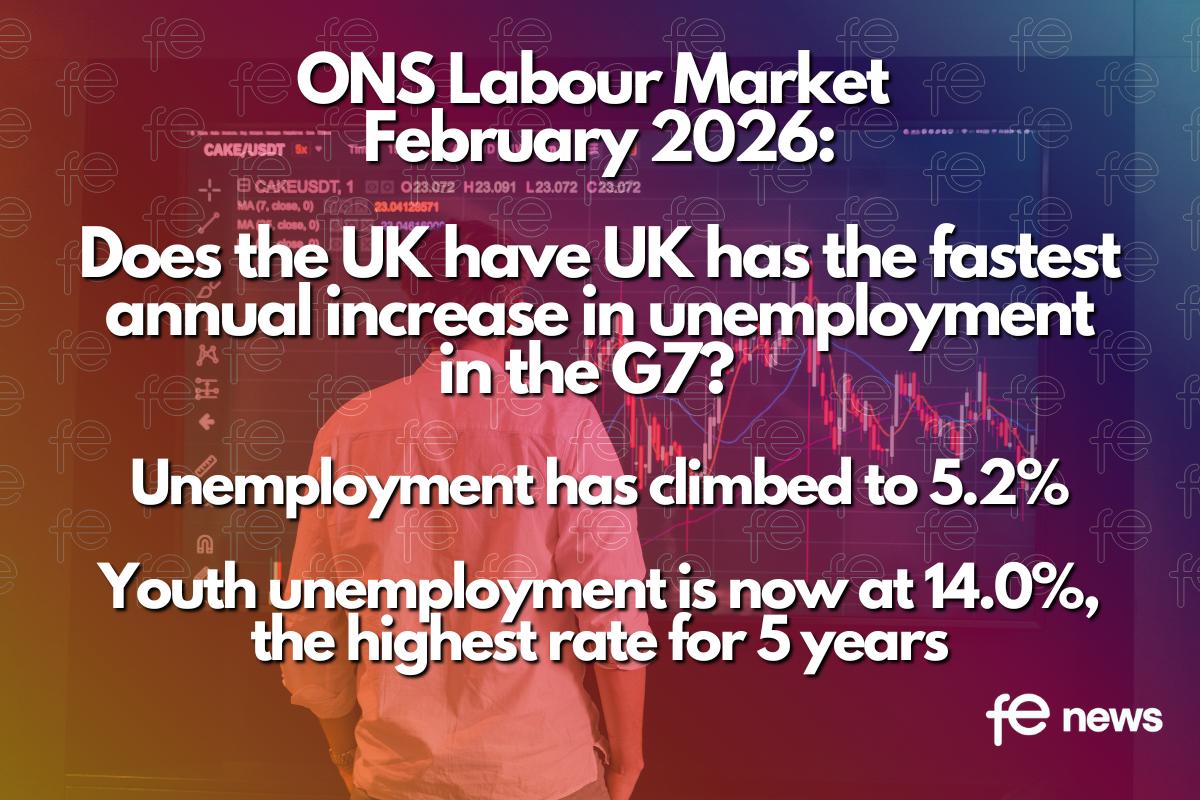

More Jobseekers Per Vacancy as Unemployment Hits 5.2%- The UK’s unemployment rate has climbed to 5.2%, reaching its highest level in nearly five years and signalling a further cooling of the labour market. The latest figures from the Office for National Statistics (ONS) show that the jobless rate rose in December to its highest point since the three months to January 2021.

The increase marks a notable shift from 2024, when unemployment stood at 4.1% as Labour entered office pledging to prioritise economic growth. Since then, a combination of rising employment costs, regulatory changes and broader economic pressures appears to have dampened hiring momentum.

A key feature of the latest data is the growing imbalance between jobseekers and vacancies. While the total number of advertised roles has changed little in recent months, more people are actively searching for work. As a result, the number of unemployed individuals per available job has reached a new post-pandemic high.

This shift suggests that competition for roles is intensifying, even without a dramatic collapse in vacancies. For employers, it means a larger talent pool to choose from. For jobseekers, however, it signals a tougher environment in which securing work may take longer.

Redundancies are also trending upwards. Although not yet at levels associated with severe downturns, the increase indicates that some businesses are trimming headcount. In many cases, companies are opting not to replace departing staff or are restructuring in response to rising operational costs.

One of the most significant pressures facing employers this year has been the increase in National Insurance contributions, which came into effect in April. The change has raised the cost of employing staff, particularly for labour-intensive sectors such as retail, hospitality and social care. When employment becomes more expensive, firms often react cautiously — slowing recruitment, freezing hiring or scaling back expansion plans.

At the same time, new workplace legislation has altered the employment landscape. The Employment Rights Act, which became law in December, introduced day-one entitlements for parental leave and statutory sick pay, among other protections. While designed to enhance job security and fairness for workers, some employers argue that the reforms add administrative complexity and financial risk, particularly for smaller firms.

Survey evidence from the Chartered Institute of Personnel and Development (CIPD) suggests that more than a third of employers are reducing hiring activity as a result of the combined impact of higher costs and regulatory changes. Business groups have warned that the cumulative burden may weigh on recruitment decisions in the short term, even if the long-term aim is to create a more stable workforce.

The broader economic backdrop is also playing a role. Growth has remained subdued, with consumer demand uneven and business investment cautious. In such conditions, companies are less likely to expand payrolls aggressively. Instead, many are prioritising cost control and efficiency.

Despite the clear upward trend in unemployment, the ONS has continued to advise caution in interpreting monthly labour market movements. Ongoing concerns about survey response rates and data reliability mean that short-term fluctuations should be treated carefully. Nonetheless, the overall direction points to a labour market that is no longer as tight as it was during the immediate post-pandemic recovery, when vacancies surged and employers struggled to recruit.

For policymakers, the rise in unemployment presents a delicate balancing act. Efforts to strengthen worker protections and increase public revenues must be weighed against the risk of discouraging job creation. If hiring remains subdued and redundancies continue to edge up, pressure may grow for measures aimed at stimulating business confidence and investment.

For now, the latest figures paint a picture of a labour market in transition. Vacancies have not collapsed, but the surge in jobseekers has altered the balance. With more candidates competing for each role and employers facing higher costs, the era of acute labour shortages appears to be fading. Whether this marks a temporary adjustment or the beginning of a more sustained slowdown will depend largely on the trajectory of economic growth in the months ahead.

Rubio Signals Steady U.S. Support for NATO, With Expectations Attached | Maya