Festivals and Growth Get a GST Push: As the festive season approaches, India is preparing for a wave of consumer spending. Navratri, beginning on 22th September 2025 and running until 2th October 2025, will mark the start of celebrations across the country, followed by Dussehra on 2th October and the much-awaited Diwali on 23th October 2025. These festivals traditionally bring a surge in purchases—from new clothes and jewelry to vehicles, appliances, and real estate. A reduction in Goods and Services Tax (GST) during this time could act as a powerful incentive, encouraging households to spend more freely while giving businesses a much-needed boost.

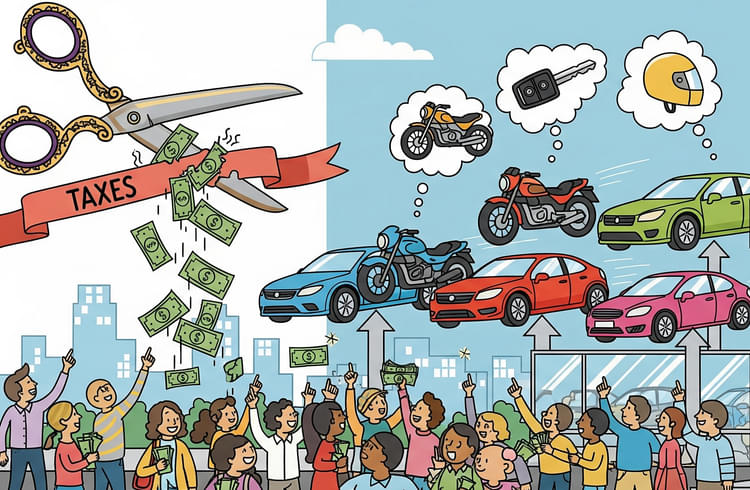

Lower GST rates directly translate into lower prices, making products more affordable at a time when families are already inclined to invest in big-ticket purchases. This effect is amplified during festivals, when cultural traditions and seasonal discounts combine to drive demand. A tax cut across consumer goods, electronics, automobiles, and even services like dining and hospitality would not only brighten the mood of customers but also uplift industries that thrive on festive momentum.

The Goods and Services Tax (GST) has become one of the most important revenue streams for the government and a critical factor shaping business costs in India. Any change in GST rates has a direct and immediate impact on prices, consumption, and market sentiment. A reduction in GST is widely viewed as a move that not only lifts consumer confidence but also injects new energy into the economy.

Lower Prices, Higher Demand

When GST rates are reduced, the most visible outcome is lower prices for goods and services. Whether it is automobiles, consumer electronics, household items, or even dining out, a cut in tax rates makes these products more affordable. For the average consumer, this reduction translates into real savings, and in a country where price sensitivity is high, even a small cut can encourage spending.

GST Rates at a Glance

India’s GST system currently operates under multiple tax slabs, depending on the category of goods and services:

0%: Essential items like fresh fruits, vegetables, milk, and books.

5%: Daily-use items such as packaged food, footwear under ₹1,000, and certain medicines.

12%: Processed foods, computers, and certain household items.

18%: Consumer durables, electronic appliances, restaurants, and many services.

28%: Luxury goods like cars, premium bikes, tobacco products, and high-end consumer items.

These rates determine how affordable products are for the consumer and how much revenue the government collects. A reduction in any of these slabs—especially the 18% and 28% categories—has an immediate and visible effect on demand.

Boost to Consumption and Growth

Economies grow when people spend more. Lower taxes expand the purchasing power of households, leading to increased demand across sectors. In turn, companies experience higher sales, expand production, and generate more jobs. This cycle creates a multiplier effect that benefits not just the consumer, but also businesses and the broader economy.

Positive Stock Market Sentiment

Financial markets respond quickly to government policy decisions, and tax reductions are generally taken as a pro-growth signal. Sectors directly impacted by GST cuts—such as fast-moving consumer goods, real estate, automobiles, and hospitality—often witness an immediate surge in stock prices. Investors interpret such decisions as government support for industry revival, which fuels overall market optimism.

A Festival Season Advantage

In India, festival seasons—from Diwali and Dussehra to Christmas and New Year—are traditionally associated with higher spending. Families invest in new clothes, home appliances, vehicles, and even real estate during these months. A reduction in GST during this period can act as a strong stimulus by encouraging consumers to advance purchases or spend more freely. Retailers and manufacturers also benefit from the festive rush, turning what might have been a modest season into a record-breaking one.

Relief for Struggling Sectors

Certain industries face cyclical slowdowns or structural challenges. For example, real estate often suffers from unsold inventory, while the hospitality sector may struggle with high costs and fluctuating demand. A targeted reduction in GST can ease these burdens, attract more customers, and revive business activity. This not only helps companies recover but also protects jobs in labor-intensive industries.

Balancing Growth and Revenue

While GST reductions boost demand and support growth, they also cut into government tax collections. Policymakers must therefore strike a careful balance: stimulating the economy through tax relief while ensuring that fiscal health remains intact. Increased compliance and higher overall consumption, however, can often compensate for the initial revenue shortfall.

In Note:

A cut in GST rates is more than a tax adjustment—it is a signal of the government’s intent to stimulate growth, boost market sentiment, and empower consumers. During festival seasons, when spending naturally rises, such a move can unlock significant gains for businesses and lift the overall economy. In the long run, a well-timed GST reduction can serve as a powerful tool to revive demand, attract investment, and set the stage for sustained economic growth.