Those days of screaming for the favorite shares, price spikes, and the excitement of the stock exchange are completely forgotten. Even while orders are now placed automatically and trading is done through computers, it was the old-fashioned trading days that established the majority of the world’s public securities, which now total more than $90 trillion. How did the stock market develop, how did it come to be, and what was traded? we’ll look at some of the historical influences that helped to create the market where We typically make money.

History of stock market

After seeing the lush gardens, picturesque towns, and beauty of Belgium you may not associate it with the financial market but In the late 1400s, Belgium became the epicenter of global trade. Merchants purchase items in anticipation of rising prices in order to profit.

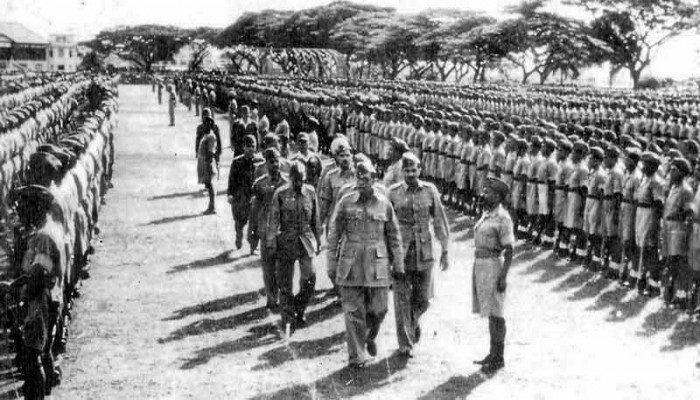

In the 1600s, the Dutch, British, and French governments all gave charters to businesses with East India in their names. On the cusp of imperialism’s excessive point, it seems like each person had a stake in the earnings from the East Indies and Asia besides the humans dwelling there.6 Sea voyages that introduced returned goods from the East had been extraordinarily risky—on top of Barbary pirates, there had been the more common dangers of climate and bad navigation.

To reduce the risk of a lost ship ruining their fortunes, ship owners had long been searching for investors who would put up money for the voyage—outfitting the ship and crew in return for a share of the proceeds if the voyage was once successful. These early confined legal responsibility companies regularly lasted for only a single voyage. They were then dissolved, and a new one used to be created for the subsequent voyage. Investors unfold their threat by investing in countless distinctive ventures at identical times, thereby taking part in the odds in opposition to all of them ending in disaster.

When the East India organizations had been formed, they changed the way enterprise was done. These organizations issued inventory that would pay dividends on all the proceeds from all the voyages the organizations undertook, rather than going on voyages with the aid of voyages. These were the first current joint-stock companies. This allowed the groups to demand more for their shares and construct larger fleets. The size of the companies, combined with royal charters forbidding competition, meant large income for investors.

More and more investors joined in as time went on and began to invest in the business. A secondary market was established as a result of shareholders being permitted to sell their assets to other traders and liquidate their holdings.

1611 saw the beginning of contemporary stock trading in Amsterdam. The Dutch East India Company was the first publicly traded entity and, for a while, the only company with exchange trading activities. Few people began trading stocks and bonds on a daily basis in the late 1700s; this activity eventually gave birth to the New York Stock Exchange.

1896 Created the Dow Jones Industrial Average. It formerly had 12 parts, the majority of which were industrial companies.1923 Poor’s Publishing, a division of Henry Barnum Poor, is the company that developed the first S&P 500 index. It starts out by monitoring 90 stocks across the exchange.

How the stock market works :

A stock exchange is an alternate (or bourse) where stockbrokers or traders may purchase or sell shares (equity stock), bonds, or mean securities. Many large businesses hold their shares listed on a stock exchange. This makes the stock extra liquid and therefore extra desirable according to many investors.

Some big companies will hold their stock listed on more than one exchange in different countries, therefore attracting international investors. Stock exchanges can also additionally cover other kinds of securities, namely fixed-interest securities (bonds) or derivatives, which are more probably to be traded OTC.

Trade into stock markets means the transfer of a stock or security from a seller to a buyer. This requires these two parties to admit a price. Equities recommend a possession of an interest in a specific company.

watch our full video on a related topic here – https://www.youtube.com/watch?v=tVET5JbkiOY

Participants within the stock demand range from small odd stock investors to large investors, and may stand primarily based somewhere in the world, yet may also include banks, insurance companies, pension resources, or hedge funds. Their buy-then-sell orders might also remain executed concerning their part by a stock trade trader.

Some exchanges are physical locations the place transactions are received out on a trading floor, by an approach recognized as open outcry. The other type of stock exchange has a network of computers where trades are done electronically. An example of such an exchange is the NASDAQ.

A viable buyer bids a unique rate for a stock, and a doable seller asks a particular price for the same stock. Buying or selling at the Market means you will receive any ask rate or bid rate for the stock. When the bid and ask Rate match, a sale takes place, on a first-come, first-served basis if there are a couple of bidders at a given price.

The reason for a stock trade is to facilitate the exchange of securities between buyers and sellers, providing a marketplace. The exchanges grant real-time buying and selling information on the listed securities, facilitating price discovery.

Size of the business sectors

Since 1980, the total market value of all publicly traded securities has increased from US$2.5 trillion to US$124 trillion.

There are 60 stock exchanges worldwide as of around 2016. 16 of these exchanges, which account for 87% of the total market capitalization globally, have a market value of at least $1 trillion. These 16 exchanges, with the exception of the Australian Protections exchange, are all located in North America, Europe, or Asia.

As of January 2021, the United States of America had the largest securities exchanges globally (about 55.9%), followed by Japan (about 7.4%) and China (about 5.4%).

That’s a brief overview of the history and operation of stock exchanges. While making this video, I thought it was fascinating to see how the East India Company began trading in earlier decades. Leave a comment below with your opinions.