How Massachusetts Invented Paper Currency!

Hold onto your wallets, because this story is about to change how you think about money. Picture this: it’s 1690, and Massachusetts is in a full-blown cash crisis. Coins? Practically nonexistent. Bartering with corn and furs? Totally a thing. But then, the colony drops a financial bombshell—they invent paper money. Yep, before Venmo, before credit cards, even before dollar bills, Massachusetts was out here printing the first paper currency in the Western world. Why? Because they had to pay soldiers after a failed military expedition, and let’s just say, their coin stash was running on empty. What happened next was a game-changer for economies everywhere. Are you ready to discover the strange beginnings of paper money? Let’s go!

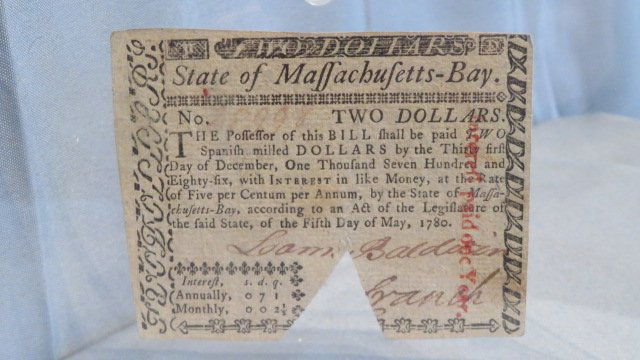

The Birth of Paper Money in Massachusetts

It’s the late 1600s, and the Massachusetts Bay Colony is thriving but facing a big problem—there’s not enough physical money to go around. Back then, coins were the primary form of currency, and they were often in short supply. Colonists relied heavily on bartering, using goods like corn, furs, or even wampum (shell beads used by Native Americans) to trade. But as the economy grew, this system became cumbersome. Something had to change.

In 1690, Massachusetts took a bold step that would forever change the course of financial history. The colony decided to issue its own paper money, becoming the first place in the Western world to do so. This wasn’t just a random experiment; it was a response to a very real crisis.

Why Paper Money?

The immediate trigger for this innovation was a military expedition. In 1690, Massachusetts sent soldiers to fight in King William’s War, a conflict between England and France. The expedition to Quebec didn’t go as planned—it failed, and the soldiers returned home expecting payment for their service. But the colony’s treasury was empty. There simply weren’t enough coins to pay the troops.

Faced with this dilemma, the colonial government came up with a creative solution: they printed paper notes, called “bills of credit,” and promised to redeem them later with gold or silver. These notes were essentially IOUs, but they were accepted as legal tender within the colony. This marked the birth of paper currency in America.

How Did It Work?

The first paper money issued by Massachusetts wasn’t like the crisp bills we use today. These early notes were handwritten and signed by officials to ensure their authenticity. They came in small denominations, making them practical for everyday transactions. The government also promised to eventually redeem the notes with interest, which helped build trust in the new system.

At first, people were skeptical. After all, this was a radical idea—money made of paper instead of precious metals. But over time, the convenience of paper currency won people over. It was easier to carry, could be used for larger transactions, and helped stimulate trade and commerce.

Challenges and Lessons

Of course, the system wasn’t perfect. One major issue was inflation. Since the colony kept printing more money to cover its expenses, the value of the bills began to drop. This taught early Americans an important lesson about the dangers of over-issuing currency. Still, the experiment was groundbreaking and set the stage for future financial systems.

Massachusetts’ paper currency also influenced other colonies, many of which began issuing their own bills of credit. This early form of money laid the groundwork for the modern financial systems we rely on today.

Looking back, Massachusetts’ decision to issue paper money was a bold move that reflected the colony’s resourcefulness and adaptability. It wasn’t just about solving a short-term problem—it was about reimagining how money could work in a growing economy. This innovation lead the way for the development of modern banking and finance, not just in America but around the world.

From Bezos to Putin: How the Yacht Industry is Turning Waves into Billions | Maya