Why China Remained the King of Commodities in 2025 — and Future Trends Amid Global Tensions

In 2025, China continued to dominate the global commodity landscape. Its influence extended beyond mere consumption; the country’s imports, exports, and strategic trade policies actively shaped global supply chains and commodity prices. From industrial metals and energy to agricultural products, China’s market behavior set trends worldwide.

This article explores the key factors behind China’s dominance in 2025, provides concrete data, and examines future trends amid rising global geopolitical tensions.

1. Massive and Diverse Commodity Demand

China’s status as the world’s largest commodity consumer remained unchallenged in 2025. Its demand spanned multiple sectors, from metals to energy and agricultural goods.

-

Iron Ore: China imported approximately 1.28 billion tonnes, accounting for roughly 75% of global seaborne trade. Steel production and strategic stockpiling drove much of this demand.

-

Copper: Imports reached around 6.2 million tonnes, up nearly 24% year-on-year, supporting manufacturing, construction, and renewable energy infrastructure.

-

Aluminum: China consumed over 36 million tonnes, making it both the largest producer and importer globally.

-

Crude Oil: Imports totaled nearly 210 million tonnes, reflecting sustained industrial and transport energy needs.

-

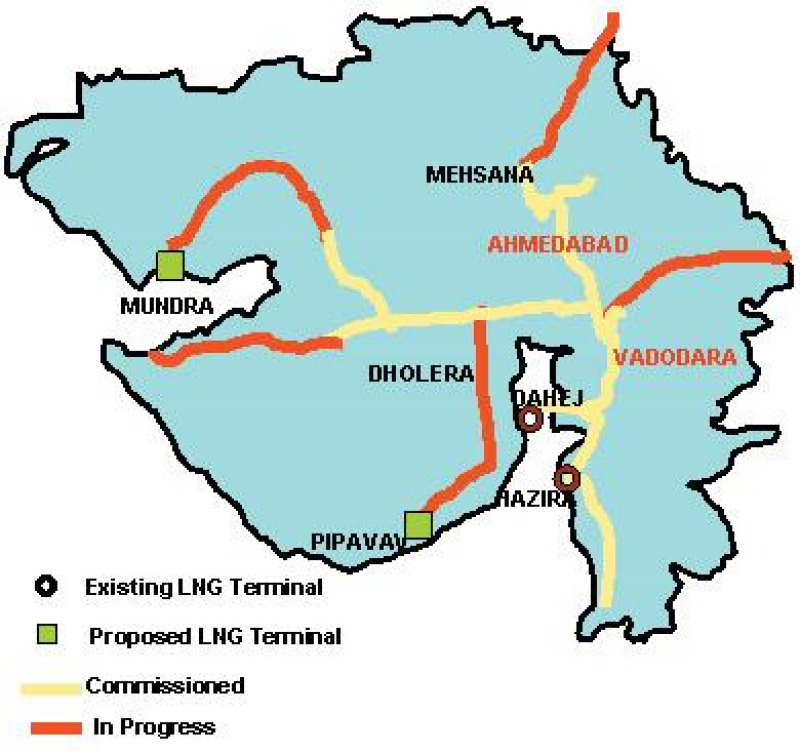

Natural Gas & Naphtha: China imported around 100 billion cubic meters of natural gas and 16–17 million tonnes of naphtha, emphasizing its role in refining and chemical production.

-

Agricultural Commodities: Soybean imports reached nearly 86 million tonnes, while wheat and corn imports added another 15–18 million tonnes, highlighting China’s influence on global agricultural trade.

Even with some fluctuations in specific sectors, the sheer scale of China’s demand made it central to global commodity markets.

2. Export Strength and Industrial Influence

China’s global influence was reinforced by its robust export sector:

-

Exports of machinery, electronics, and processed metals reached $4.1 trillion, contributing to a record trade surplus exceeding $1 trillion.

-

China’s dual role as both the largest commodity consumer and a major exporter of manufactured goods amplified its leverage over global supply chains.

This combination of high import demand and strong exports ensured China remained a critical player in determining global commodity trends.

3. Strategic Procurement and Market Responsiveness

China’s commodity strategy in 2025 reflected a mature, price-sensitive approach:

-

The country reduced imports of some commodities, such as coal, while increasing or maintaining imports of metals and strategic materials.

-

Such selective procurement allowed China to influence global prices, stabilize domestic markets, and maintain industrial output without overextending its reserves.

This strategic agility ensured that China was not just a passive consumer, but an active market shaper.

4. Geopolitical and Trade Tensions

China’s commodity dominance occurred amid a complex geopolitical environment:

-

Trade tensions with the U.S. and other partners encouraged diversification of supply chains and careful management of strategic exports like rare earth elements.

-

Global uncertainty increased demand for safe-haven commodities such as gold, indirectly enhancing China’s influence on these markets.

-

Policy adjustments and export controls reflected an effort to balance domestic needs with global market positioning.

Even in times of international tension, China’s commodity behavior continued to set market signals worldwide.

5. Future Trends Amid Global Uncertainty

Looking beyond 2025, several trends are likely to shape China’s commodity role:

a) Supply Chain Diversification

Trade tensions are pushing China and other countries to diversify suppliers, reducing dependence on any single country and mitigating risk in critical commodities.

b) Strategic Minerals and Energy Transition

China’s dominance in rare earths, lithium, and cobalt positions it to lead the global clean energy transition, especially in electric vehicle and battery production.

c) Price Dynamics and Market Adjustments

Global commodity prices may soften due to slower growth, oversupply, or geopolitical disruptions. China’s strategic import policies will continue to buffer domestic markets and influence global pricing.

d) Regional Trade Partnerships

China is deepening trade relationships with emerging regions such as Africa, Southeast Asia, and Latin America. These partnerships help secure raw material supply and mitigate the impact of Western trade restrictions.

China’s Strategic Commodity Supremacy

In 2025, China remained the world’s commodity superpower due to:

-

Massive and diverse import demand

-

Strong export and industrial capacity

-

Strategic, price-sensitive procurement

-

Effective navigation of global trade tensions

Looking ahead, geopolitical uncertainty, shifting supply chains, and energy transitions will create new challenges. Yet China’s scale, strategy, and market influence ensure it will remain central to global commodity markets for years to come.

Is Sapodilla the Best-Kept Secret in Tropical Fruits? | Maya